Money originated from blood money, wergild, how appropriate when you think about it. This was a payment that had to be made to the family of who was killed or hurt. The price of blood, usually, the monetary value determined of the injury done. Now, when you think about the bastards you have done business with and their morally repugnant behaviour it all makes sense somewhere (LOL).

“Many societies had laws requiring compensation in some form for crimes of violence, instead of the Old Testament approach of “an eye for an eye”. The author notes that the word to “pay” is derived from the Latin “pacare” meaning originally to pacify, appease, or make peace with – through the appropriate unit of value customarily acceptable to both sides. A similarly widespread custom was payment for brides in order to compensate the head of the family for the loss of a daughter’s services. Rulers have since very ancient times imposed taxes on or exacted tribute from their subjects. Religious obligations might also entail payment of tribute or sacrifices of some kind. Thus in many societies there was a requirement for a means of payment for blood-money, bride-money, tax or tribute and this gave a great impetus to the spread of money.”

This would morph from a payment owed to the family that had been transgressed against into a fine imposed by the state for such crimes. This, indeed, is the situation we have today. Thus, money became an instrument centred upon and driven by the state. Money cannot be separated from the state or government of the day. Money is the sovereign currency of the state. Money is issued by the state.

Blood Money & Taxes

Money and taxes are inextricably linked. Money is an IOU from the state. Cash money was created by governments for the payment of taxes. Some citizens still feel that paying taxes are akin to blood money. For many people their whole lives revolve around money. The getting of it and the keeping of it. ‘You cannot get blood out of a stone’, is a well-known expression. The strong feelings around money are almost universal. Money is like a chain that ties us all to the state and government of which we are citizens or denizens of. The popular aspiration is to have more money and pay less tax. However, you cannot have one without the other, both historically and economically today.

Money Today Figures On A Screen

The recent demise of cash has, perhaps, hidden the blood money roots of our currency. Money has become figures on a screen, as the digital world has taken over most transactions these days. The cash economy, black money, remains the favoured realm for dirty deeds and the criminal sphere. Money has, therefore, become more intangible and less a real thing for most of us. It still is the main measure of success and security in the mind’s of the majority. It continues to hang over our lives like a flashing sign on the highway directing us. The question, then, emerges, do we understand money?

Do we know what it is and how we should interact with it?

What Is Money?

Some of us work for money and some make money work for them. Master or slave, which are you? Some folks profess to love money and others prefer not to mention its name. A necessary evil or a labour of love? Money is divisive in terms of creating haves and have nots. The financial sector is peopled by professionals like economists and accountants. These are individuals who have devoted their lives to the study and business of money. National governments with a sovereign currency have a monopoly over the production of their money. They control their money through their central bank.

Inflation & Money

Inflation is a problem around the world right now, according to the central banks. Since the global pandemic, prices have gone up for food, energy, and shelter. The finger has been pointed at the government money handed out to individuals and businesses to keep the economy going. High inflation is understood to be caused by too much money chasing too little supply of goods and services. The housing sector, in particular, is suffering from this and rents have sky rocketed in Australia and the US. The central banks have been steeply raising interest rates to dampen demand. In the immediate term, this has been making the housing crisis worse. If the market requires more housing stock it is hard to see how making things more expensive will facilitate achieving this. L, Randall Wray, an economist well known for Modern Money Theory, tells us that our inflation is a supply side problem. The supply of stuff has been hampered by bottlenecks initially caused by the pandemic. He reckons that monetary policy, raising interest rates, will not be a timely solution to this kind of inflation. Oil and gas prices have been high due to Russia’s invasion of Ukraine and now the Israel war with Hamas, and OPEC has been cutting supply. This impacts upon the price of food because of manufacturing and transport distribution costs. Food prices have started to come down but inflation is sticky in the service sector now. Meanwhile, corporations have been price gouging and taking advantage of the many oligopolies within markets to price set. Companies have been declaring record profits.

There is no wage- price -spiral happening. There has been, rather, a profit-price-spiral occurring.

Austerity & The Central Banks

Austerity is the traditional economic antidote for high inflationary periods. This involves poorer folk taking it in the neck whilst a recession is triggered in the never ending boom and bust cycle. Unemployment must rise according to those steering the ship at central banks for the economy to reset. GDP rates are down globally. A slowing economy will take longer to adequately house those who cannot find or afford rentals in the currently inflated market. Suffering will be prolonged and meanwhile, the Australian government is bringing in record levels of new migration into the country. This makes the housing crisis even worse, of course. This push and pull methodology within the economy sees economic productivity go up with the influx of cashed up new migrants entering the country. Government spending is being reined in and there is talk of putting new infrastructure projects on hold. All of this is being done under the aegis of bringing the inflation rate back down into the 2% to 3% range. It is currently around 5.4%.

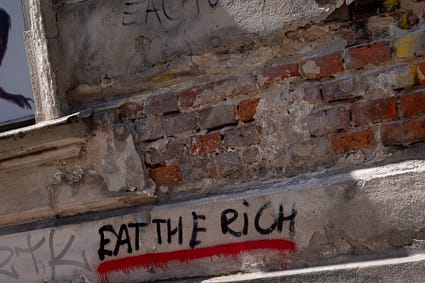

Talk about blood money is not far from the reality of economic management right now. Many people are angry at the cost of living with wages falling further behind rising prices. The government is seen as impotent because of the austerity measures it keeps talking about. The working poor are suffering and falling further behind economically. Money originated from blood money and the game has not changed that much in the 21C.

Robert Sudha Hamilton is the author of Money Matters: Navigating Credit, Debt, and Financial Freedom.

©WordsForWeb

2 thoughts on “Money Originated From Blood Money”