My heart feels for the forgotten Australians. For those who missed the advantages of well heeled parents and private schools. For those who never quite managed to save up enough for a deposit on a home. For those who rent their residence in an ever shrinking market but now pay through the nose. My heart goes out to the third of Australians forgotten by governments and swept under the rug of their lost concerns. Are we returning to an age where money and property determined your rights in the world? Perhaps, we never really left that unfair realm.

My Heart & The Many Forgotten Australians

My heart hurts for the many who feel left out of the conversation about what kind of place Australia should be. For the forgotten Australians whose lives may include homelessness at age 50 and may be living in tents on the fringes of cities. For those whom a decent living eluded them despite their trying. For those who are now locked out of the property market despite having a job and working for years.

My heart goes out to the half a million Australians accused by Robodebt of owing money to the government – despite the illegality of it at the time. My heart goes out to those who took their lives because of this.

Home Ownership The Forgotten Australian Dream

The Australian governments of the last 30 years have overseen a rearranging of the rules. They have governed whilst opportunity has marked the cards of some and illuded many others. Housing prices have gone through the roof during this time and working wages have been decimated in terms of buying power for property.

“But long before this inflation crisis, a similar phenomenon has been eating away at the value of the money we use to buy a home.

Since the early 1990s until recently, the average annual rate of inflation in consumer prices has been 2.5 per cent, so it may have felt like the value of our currency was relatively stable before the pandemic.

But the value of our dollar hasn’t been maintained in every market.

When it comes to the property market, it’s been obliterated.

Property price inflation has killed the Australian Dream of widespread home ownership for younger generations.

Why did policymakers let this happen?

In the post-war years, it typically cost two to three times average household earnings to buy a property.

Today, it’s up to six to 10 times (or even higher).”

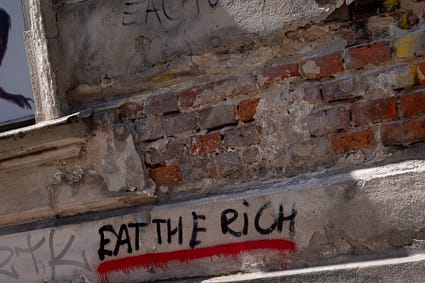

The wealthy, those made wealthy by the property boom, do not want anything to change now. Thus, those with the rough end of the pineapple are stuck with it because the political parties are too afraid to do anything about it. We are a nation of haves and have nots, which is rapidly getting more unfair every day. We are going backwards into the past, where gross inequality was the order of the day.

Crime and revolution will be coming our way very soon, as it always does when things are this unfair. Even the apathetic Australian will rise up, as poverty and despair meets rage.

The Remit Of The RBA

“But then, on the other hand, in some of the RBA’s modern educational material, the bank has dropped the phrase “stability of the currency” and replaced it with “price stability.”

That makes it sound like the RBA is supposed to be maintaining the stability of prices inside Australia’s economy (i.e. domestic inflation).

So which one is it? It turns out it’s both.

It’s often forgotten, but the RBA’s charter didn’t originate in the Reserve Bank Act 1959. It was inherited almost word-for-word from the Commonwealth Bank Act 1945.”

- (Gareth Hutchens, ABC News, April 2023)

As the excellent and highly recommended article by ABC journalist Gareth Hutchens says, The RBA is supposed to be ensuring price stability and the economic prosperity and wellbeing for all Australians – not just the propertied class.

The results as seen in 2023 indicate that this is not the case. Governments and the RBA have failed a third of Australia at least. The property market in Australia has long been out of control. Now, rental stocks have dwindled to the lowest on record, which has meant that they are unaffordable for many working Australians. The market has raised rents by 20% and 30% and lifted them out of their reach. The neoliberal free market, so beloved by politicians on both sides, has shafted the people. Housing is an essential, not some discretionary thing to be played with by market forces.

Governments stopped building social housing a while back because they were assured that the market would take care of everything. Well, that didn’t happen. Did it!

What do we hear now but empty platitudes out of the mouths of politicians. Too politically gutless, however, to actually do anything about the housing crisis. More concerned with keeping their seats than doing what is really needed.

My heart feels for the forgotten Australians.

Robert Sudha Hamilton is the author of Money Matters: Navigating Credit, Debt, and Financial Freedom.

©WordsForWeb